Bizly Risk Scores

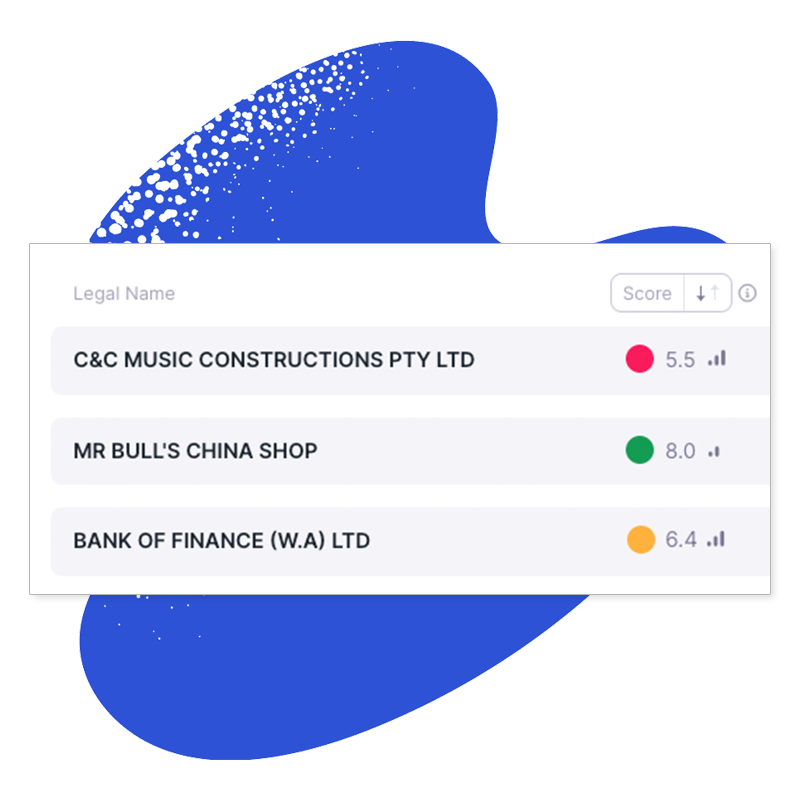

Free business risk scores (between 0-10) so you can spot potential issues with a business before or while trading with them.

"Issues" means any of hundreds of things we track that might make you reconsider trading with that business.

The lower the Bizly score, the higher the business risk. Scores also come with a Data Signal which shows how much, and what kind of, data was available to create the score.

The only place to get free risk scores for any Australian business.

Bizly looks at current and historical information about a business to see if there are any issues you should be concerned about in the short term, then turns that into a score between 0-10 you can access for free.

What do we mean by "issues"? It can be anything from worsening payment behaviour, to legal issues, to insolvency and more - things that would make you reconsider trading with that business.

At its heart it's like Google Reviews but for business risk. You use Google Reviews to avoid bad (or find good) Thai food or tradies. Now you can use Bizly to avoid risky business customers and suppliers.

Learn More About Bizly Risk Scores

What does an E in the category icon mean?

How Are Bizly Scores Calculated?

How are Bizly Scores Different to a Traditional Commercial Credit Score?

How Much Do Bizly Risk Scores Cost?

Why is Bizly So Affordable Compared to Traditional Credit Scores?

Understanding Scores

We've made scores simple to understand - The lower the score, the higher the risk there will be an issue. Conversely, the higher the score, the more reliable a business is likely to be.

Examples of reasons for low scores include current or past issues the business has had, problems with the industry the business is in, or even geographic issues. We go into how scores are calculated in more detail, below.

Alongside scores we also display a category and an icon that shows "Data Signal". Data Signal is the volume and quality of the inputs we've used to build the score. The higher the signal the more reliable the score is in relation to that specific business.

You can see what categories mean in the table below. You can read more about Data Signal a bit further down this page.

| Category | Score Range | Meaning |

|---|---|---|

| Very Poor | 0.0 - 5.3 | Series of significant issues. Look for alternative businesses to work with or consider completely cutting ties if currently engaged. |

| Caution | 5.4 - 6.0 | Multiple minor issues and/or one or two significant negative issues. Exercise caution. Limit exposure through smaller transactions. Be prepared to walk away if red flags materialise. |

| Average | 6.1 - 6.7 | Some minor stumbles/issues. Generally OK to trade with but monitor closely. |

| Good | 6.8 - 7.5 | Good track record. No issues of note. Low risk in trading with this business at the moment based on data available to Bizly. |

| Excellent | 7.6 - 10 | Excellent track record. Very low risk in trading with this business based on data available to Bizly. |

What does an E in the category icon mean?

In some cases you may see an "E" inside a Bizly coloured category circle. That means the business is currently in external administration.

You can read more about External Administrations and what they mean for you HERE.

How Are Bizly Scores Calculated?

Bizly Scores are calculated using thousands of possible data points.

Our data scientists use machine learning (a type of AI) to develop models based on those data points. These models are then used to analyse the data we collect about businesses so we can then produce a Bizly Score for every business in Australia.

The amount of data we have about businesses varies, so we created Data Signal, which is an indicator of how much data about a specific business has gone into calculating its Bizly Score. There's more information on Data Signal below but generally the stronger the Data Signal, the more reliable the Bizly Score will be.

What is Data Signal?

Not all businesses are created equal – at least when it comes to data. We track thousands of data points, but some companies leave a bigger digital footprint than others. Trusts and microbusinesses, for example, might not generate as much data for us to analyse as a publicly listed company.

Rather than pretend all our scores are based on the same amount of data we have created the Data Signal, which we include along side every score. This indicator - ranging from low to high - indicates the amount and specificity of data available to create the Bizly score for this business.

The more bars, the stronger the signal. The less bars, the weaker the signal and the more we rely on things like broader geographic and industry data rather than specific business information to create the score.

Below is a table explaining each of the Data Signal icons:

| Signal | Meaning |

|---|---|

| High Data Signal | We've got a good amount of info on this business, so we're confident about the accuracy of its score. |

| Medium Data Signal | There's some, but not a ton of, data specifically about this business. We've mixed what we do have with details from very similar companies to come up with its score. |

| Low Data Signal | We're working with just a little bit of data on this business. This is fairly common for smaller businesses, trusts and other businesses with little activity. To fill in the gaps, we're using whatever data we do have along with whatever other data we can infer from that limited data. |

How are Bizly Scores Different to a Traditional Commercial Credit Score?

Commercial credit scores offered by traditional bureaus predict the likelihood of an "adverse event" - something going wrong, like a director issue, business failure or late payment - in the next 12 months and were originally built for large lenders.

For most people that's simply not needed - you just want to know if there are any actual issues with a business that might affect you today and in the short-term, not in 12 months.

That said, Bizly scores are built using many of the same measures a traditional bureau uses (our Chief Data Scientist used to create business risk models for Australia's largest bureau) but we include many additional data sources and focus our AI-models on providing short term predictions.

How Much Do Bizly Risk Scores Cost?

Bizly Risk Scores are free. As in $0.(Wow!)

If you'd like details on any key events that lead to that score (e.g. how many reported payment defaults there have been in the past 12 months), a Bizly Report costs $2.95. This is in comparison to traditional credit reports that cost between $35-50.

If you'd like to monitor, and receive alerts for, any future risks including real time updates to Bizly scores, you can do that too. Check our pricing for tiers for specific but it can be as low as 0.20c/month per business tracked. Oh - and because we think you should be able to see what others are seeing about you, we give you a free report and monitoring credit that you can use to monitor your own business or another customer or supplier.

Why is Bizly So Affordable Compared to Traditional Credit Scores?

Only about 2% of businesses in Australia currently use 3rd party data to avoid bad customers and suppliers. Most of that is because of the cost (up to $50) and complexity of traditional reports and the underlying cost of data contained e.g. most credit reports come come with ASIC extracts that information brokers normally charge $20-25 for, included.

That means 98% of business, and an incredibly large number of individuals, roll the dice every time they do work with a new, or existing, business customer or supplier.

Many of our friends, whether accountants, printers, tradies or from any industry really, have told us stories about being affected by bad customers and suppliers because they either didn't know that they had a history of poor behaviour or who were great when they started working with them then ran into problems leaving our friends out of pocket.

That just didn't seem right.

We wanted everyone to have access to clear and affordable business risk information, not just lenders and big companies. That's why we took traditional credit reports and broke them down into simpler pieces that any business owner can understand.

Our free Bizly score is a great starting point, but for those needing more details, we offer in-depth reports and monitoring at a price that won't break the bank. We believe this makes Bizly unique in Australia, providing essential risk information to all businesses.

Want to take your customer insights to the next level? We also offer PayPredict, a powerful tool that integrates with Xero to provide even more accurate payment risk information. PayPredict delivers real-time cashflow predictions and helps you understand how your customers' payment behaviour can impact your business. But that's a whole other conversation!

Who is Behind Bizly?

Bizly was built by Evenly, a leader in innovative business risk insights in Australia. Our team of data, product and SME experts have been building those unique insights for over 5 years and have done work for market leading companies such as Equifax, KPMG and MYOB.

We've mixed our learnings from that work with our focus on making commercial risk insights available to all businesses in Australia to build tools like Bizly, PayPredict and more.

Believe there is an error with a Bizly Score?

If you’ve read through this page, including the section on data signal, and still believe there is an issue with a score, please send an email to support@bizly.com.au including:

- The relevant entity name

- The relevant entity ABN

- The Bizly Score or other information which you believe to be incorrect

- Whether or not you're associated with the entity or any other relevant information

Once we receive your request we'll review the information in question and respond ASAP.

Who is Behind Bizly?

Bizly was built by Evenly, a leader in innovative business risk insights in Australia. Our team of data, product and SME experts have been building those unique insights for over 5 years and have done work for market leading companies such as Equifax, KPMG and MYOB.

We've mixed our learnings from that work with our focus on making commercial risk insights available to all businesses in Australia to build tools like Bizly, PayPredict and more.

WE'D LOVE TO HEAR FROM YOU!

We'd love to hear from you with any thoughts, suggestions or feedback - or for anything else you'd like to speak with us about.

If you'd like to chat our contact details can be found HERE.